Table of Contents

This documentation provides a step-by-step guide on how to upload invoices in QuickBooks and properly record Shop Card discounts in Costco. It follows the given statement which specifies the categorization of items, the addition of charges, and the handling of Shop Card discounts.

Uploading Invoices in QuickBooks #

- Log in to your QuickBooks account.

- Go to the “Expenses” menu and select “Bills.”

- Click on the “New Bill” button to create a new bill.

- Fill in the required information such as vendor name, invoice number, invoice date, and due date. The due date must be booked every Saturday.

- Enter the individual items purchased on separate lines, including their descriptions and amounts.

- Check each item’s category (Food, Drinks, or Supplies) and record them accordingly.

- For food purchases, enter them in the “Food Purchases” category.

- For drink purchases, enter them in the “Drinks Purchases” category.

- For supplies purchases, it is entered based on whether the supplies are included in the inventory list or not.

- A. Supplies Included in Skalka Inventory v1 list – select the account “Supplies & Restaurant Expense: Restaurant Supplies” from the accounts dropdown.

- B. Supplies NOT Included in the Skalka Inventory v1 list – select the account “Supplies & Restaurant Expense: Purchases” from the accounts dropdown (Note: Cauldrones have a special categorization regardless if they are included in the inventory list. Categorize cauldrons under “Supplies & Restaurant Expense: Purchases.)

- Add any additional charges such as sales tax, energy charges, tips, or other charges to the category with the higher amount.

- For example, if an invoice with a total amount of $100 consists of $75 worth of food purchases, $24 worth of drink purchases, and an energy charge of $1, add the energy charge to the food purchases.

- Verify that the total amount entered matches the total amount mentioned on the invoice.

- Attach a copy of the invoice to the bill in QuickBooks. You can do this by clicking on the “Attach File” button and selecting the invoice file from your computer.

- Save the bill.

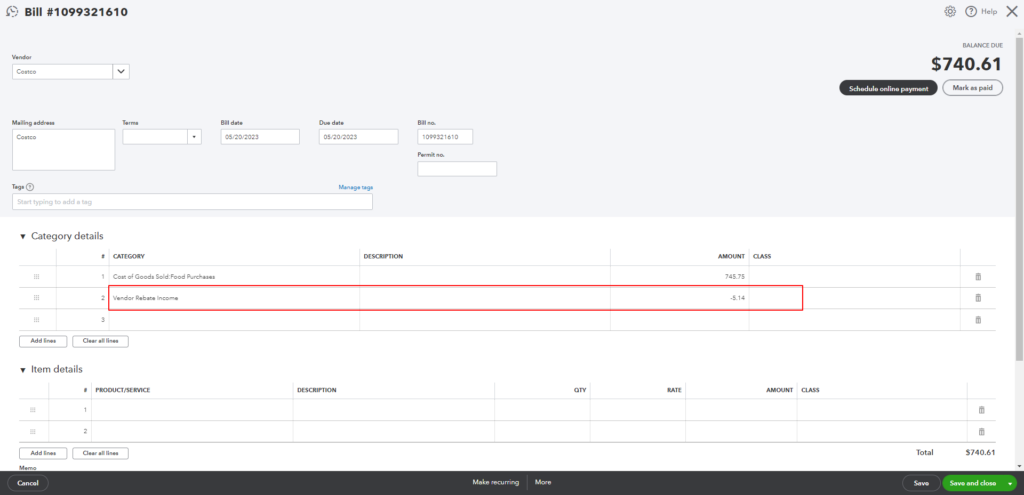

Recording Shop Card Discounts #

- For food, drink, and supplies purchases, enter the original amounts based on the invoice.

- For example, if the original invoice shows $50 for food, $30 for drinks, and $20 for supplies, enter these amounts accordingly.

- On the new line, select the appropriate account called “Vendor Rebate Income.”

- Enter the Shop Card discount amount as a negative value. This ensures that the total amount matches the invoice total.

- For example, if the Shop Card discount is $5.14, enter it as “-5.14” in the amount column.